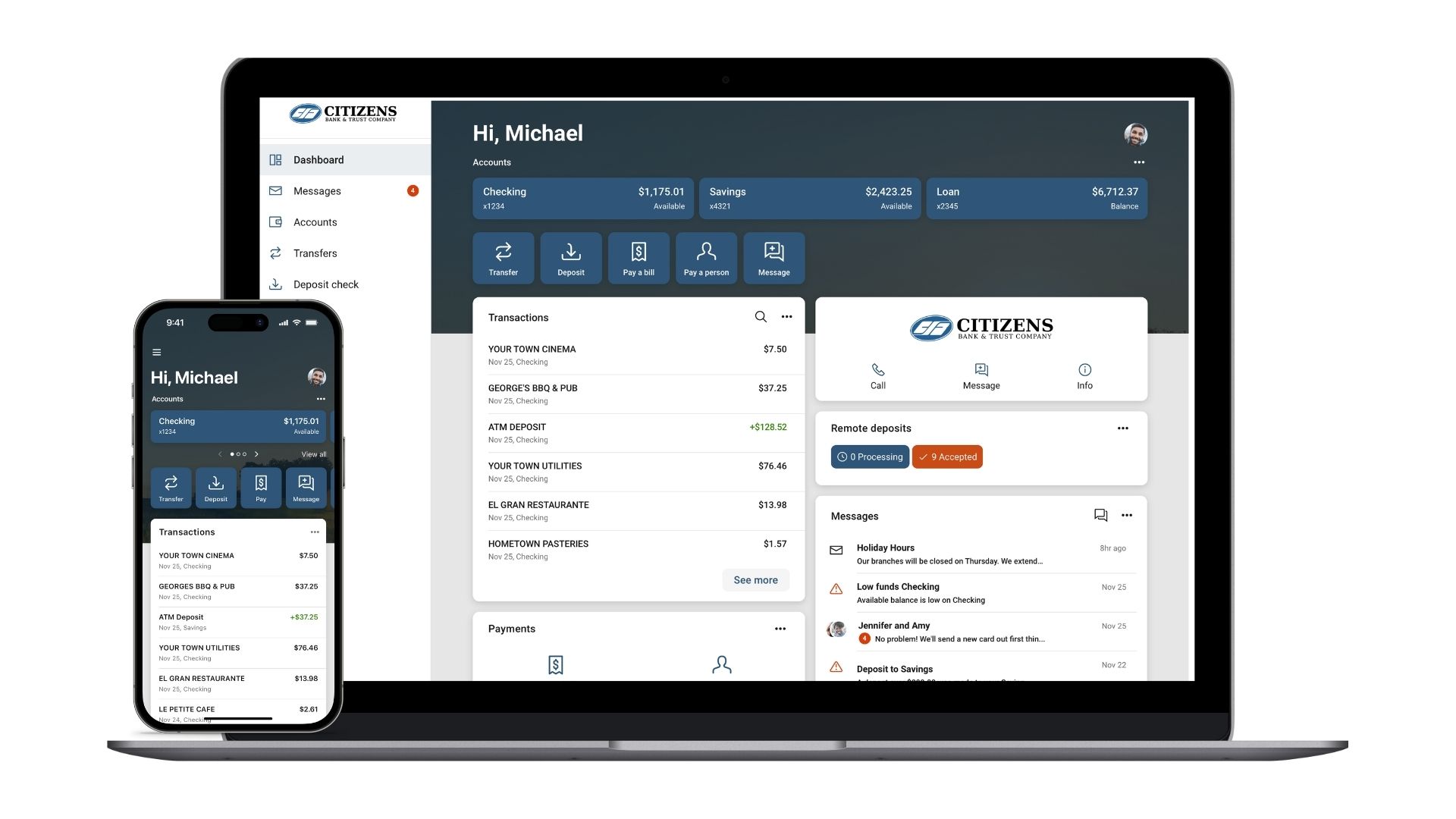

Our Digital Banking Suite (Online Banking, Mobile App, and Bill Pay) is a simple, seamless, and secure platform. Your satisfaction is our top priority, and this upgrade is designed to deliver an improved online banking experience and make managing your finances even more convenient.

Features

This upgrade creates a more modern, consistent look and feel across all your devices and simplifies how you manage your accounts and move money. So, no matter where you are or what device you want to use, you can:

- View balances: Quickly check your account from anywhere.

- Manage transactions: Search your recent activity, filter by tags, even add an image or note to an entry.

- Transfer funds: Initiate one-time, future date, or repeating transfers.

- Personalize your experience: Arrange features in a way that makes the most sense to you – customize the interface on a per-device basis and move things around however you like.

- Get alerts: Receive push notifications and alerts to stay in the know.

- And MUCH more!

-

Note: If you currently use a shortcut/bookmark tab to access your online banking you will need to delete it and re-add cbtky.com. This will just be a one-time change.

Online Banking & Bill Pay

Bill Pay is still integrated into our online banking platform. This allows you to log in to our Online Banking & Bill Pay platform with just a single sign-on. With Bill Pay, you can quickly and easily set up bill payments and pay bills to virtually anyone, anytime, anywhere.

Mobile App

To download our app, Search “CBTKY” in the App Store or Google Play Store to download the new version of our mobile banking app. Once you have the new app downloaded, please delete the old CBTKY Mobile Banking app to avoid any confusion. If you attempt to use the old version of our app, you will be redirected to the new one.

The updated CBTKY app includes an impressive list of convenient features that you are going to love!

- Biometrics or PIN authentication: Easily and securely log in using your fingerprint, face, or a personal identification number.

- View balances and account activity: Search for transactions, add a note or an image, and filter by tags. Understand your activity and find what you’re looking for – fast.

- Make deposits with a snap of your camera: Deposit checks into qualified accounts using your mobile deposit feature.

- Bill Pay: Pay bills quickly and securely.

- Transfer funds: Effortlessly initiate one-time, future date, or repeating transfers.

- Personalize your app: Arrange the app’s features in a way that makes the most sense to you – customize the app on a per-device basis and move things around however you like.

- Office and ATM locations: Find the nearest Citizens Bank & Trust Company ATM or locate an office using your current location.

Your username and password for mobile banking will stay the same. You’ll need to log in with this information before you can use features like Touch ID or Face ID. If you don’t remember your login credentials, give us a call.

First-Time Access | One-Time Passcode

-

You will use your current Citizens Bank Online Banking username and password to log in to the platform. If you are currently using biometrics (fingerprint/Face ID) to access your mobile app, please make sure you take note of your username and password as you will be required to manually enter it to log in.

-

After you put in your username and password, a one-time passcode will be sent to either the phone number or email address on file to confirm your identity. The verification code will need to be entered within 5 minutes of receiving it in order to move on to the next step.

Note: You are only required to enter a verification code the first time you log in on a specific device or internet browser. An option is given in this step to opt out of the one-time passcode for the device or browser you are using. If you choose to access your account via multiple devices or a different internet browser, the one-time passcode step will need to be completed each time.

Two-Factor Authentication (2FA)

In addition to the one-time passcode, we are also adding two-factor authentication (sometimes referred to as multi-factor authentication or MFA) to provide an added layer of security.

-

Upon completion of two-factor authentication, if you are using our mobile app, you will be asked to also create a four-digit PIN for your device. This will be used instead of your online banking username and password going forward. Once the passcode has been established, you will have the opportunity to turn on biometrics (fingerprint/Face ID) if your device has the capability. Once enabled, you will log in using biometrics with your four-digit PIN serving as a backup password in the event biometrics fails to work.

Info

For more information regarding online banking on our app or website reach out to us at 270-465-8193.